|

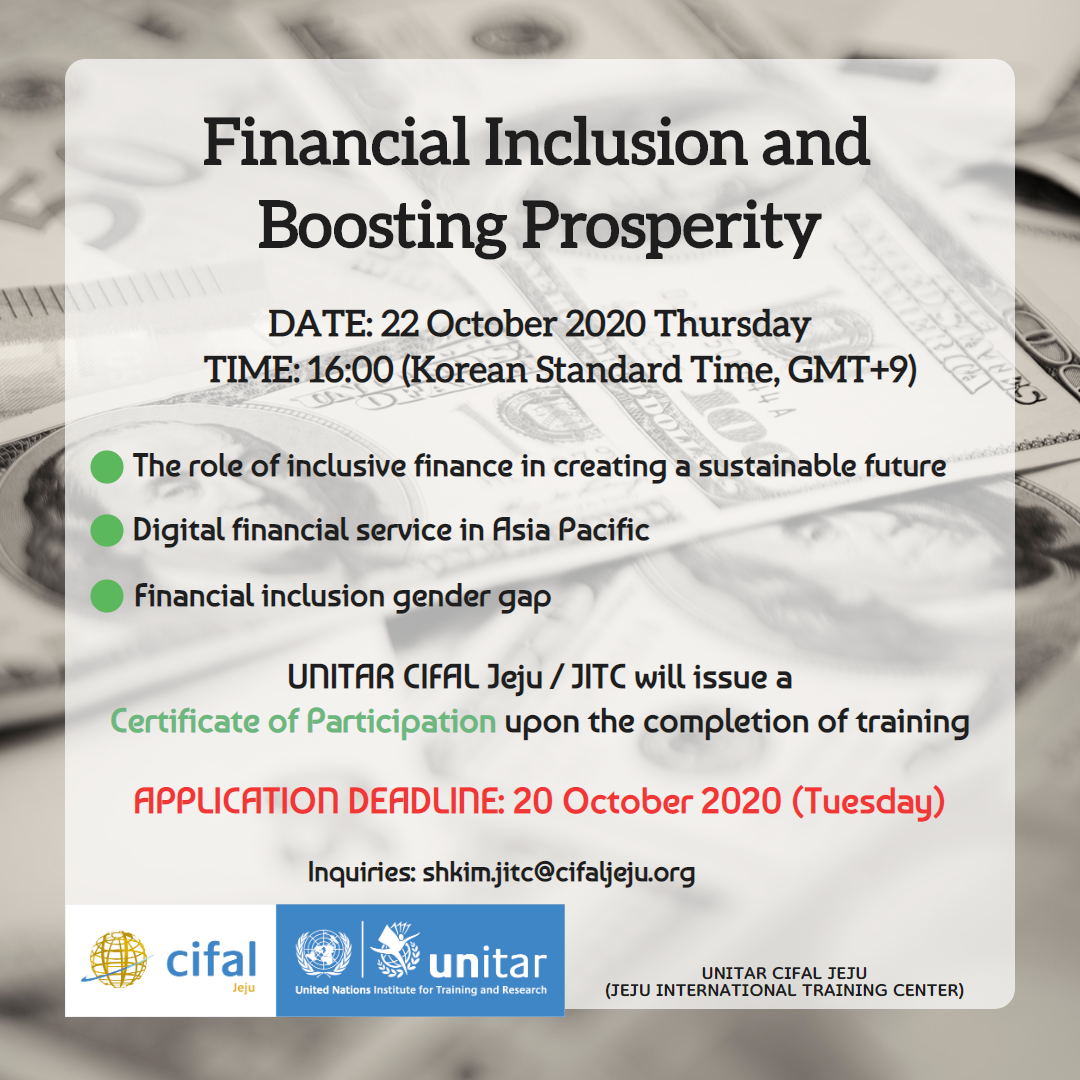

Financial Inclusion and Boosting ProsperityBackground According to the latest findings in Global Findex[1], a comprehensive database

on financial inclusion from the World Bank Group, there are around 1.7 billion

adults globally without an account. Even this number is supposed to be an

improved one since the number was 2 billion 3 years ago - certainly, more needs

to be done. Still,

women in developing economies remain 9 percentage points less likely than men

to have a bank account. Also, three countries with the largest percentages of

the world’s unbanked are in Asia – China at 13% (225 million people), India at

11% (190 million people), and Indonesia at 6% (96 million people)[2].

The market size for unbanked and underbanked individuals and enterprises is

estimated to be between US $55 billion and US $115 billion in the Asia Pacific

region[3].

Financial

inclusion means “individuals and businesses have access to useful and

affordable financial products and services that meet their needs delivered in a

responsible and sustainable way[4]”. As a basis for sustainable development, inclusive finance will be essential

in enabling people to escape poverty by facilitating investments in their

health, education, and businesses. It should be properly noted that financial

inclusion is featured (sometimes

explicitly) in at least seven of the seventeen Sustainable Development Goals.

These include SDG 1 on eradicating poverty; SDG 2 on ending hunger; SDG 3 on

profiting health and well-being; SDG 5 on achieving gender equality; SDG 8 on

promoting economic growth; SDG 9 on supporting industry, innovation and

infrastructure; and SDG 10 on reducing inequality.

There is a growing body of academic evidence that overall economic growth

and the achievement of broader development goals benefit from financial

inclusion, especially from the use of digital financial services. According to

McKinsey Global Institute, digital finance – payments and financial services

delivered via mobile phones the Internet – “could benefit billions

of people by spurring inclusive growth that adds $3.7 trillion to the GDP of

emerging economices within a decade”[5]. Supported by

ever-developing financial service and technologies, digital finance has the

potential to “grease the wheels[6]” of economic

activities. Inclusive finance can contribute to the achievement of a

sustainable economy by enabling more productive economic activities.

Based on this understanding, CIFAL Jeju organizes an online workshop on Financial Inclusion and Boosting Prosperity that aims to support the Asian Pacific government officials and leaders of society for them to make and implement policies for inclusive and sustainable economic development. By partaking in interactive discussions, participants will also be able to share best practices regarding the facilitation of inclusive finance in creating a sustainable future. [1] https://globalfindex.worldbank.org/ [2] World Bank Group,

UFA2020 Overview: Universal Financial Access by 2020, 1 October 2018,

https://www.worldbank.org/en/topic/financialinclusion/

brief/achieving-universal-financial-access-by-2020 [3] Deloitte Analysis,

based on World Bank data. Deloitte, 2020 Asia Pacific Financial Services

Regulatory Outlook, January 2020, https://www2.deloitte.

com/cn/en/pages/risk/articles/2020-asia-pacific-regulatory-outlook.html [4]https://www.worldbank.org/en/topic/financialinclusion/overview [5] https://www.mckinsey.com/featured-insights/employment-and-growth/how-digital-finance-could-boost-growth-in-emerging-economies [6]Hasan, M. M., Yajuan, L., &

Khan, S. (2020). Promoting China’s inclusive finance through digital financial

services. Global Business Review, 0972150919895348 Event details Event type Online

workshop Date & Time 22

October 2020, 4 PM (KST, GMT+9) Organizer UNITAR

CIFAL Jeju / Jeju International Training Center Certificate UNITAR CIFAL Jeju / JITC

will issue a certificate of participation upon the completion of training Target audience This

online event is open to government officials and personnel from non-profit,

civil, and private sectors in Asia and the Pacific region, including focal

points for: economic

policy, sustainable finance, financial inclusion Training (this event)

is also open to representatives from the academia, research entities,

development agencies and think tanks actively engaged in the areas stated above. Program

Application and deadline ● Apply by 20 October 2020 (Tuesday) at: shorturl.at/bhM36 ● Kindly note that only selected applicants will be notified individually ● Inquires: shkim.jitc@cifaljeju.org |